News

FCMB Provides Individuals with Convenient Vehicle Purchasing Options

-

News5 days ago

News5 days agoOfficial Cars Used By Muhammadu Buhari During His Rule As Nigerian President, Military Head Of State

-

News1 week ago

News1 week ago‘So What?’ FCT Minister Wike Defends Use Of Rolls-Royce Ghost, Said He Used Mercedes-Benz As A Student

-

News1 week ago

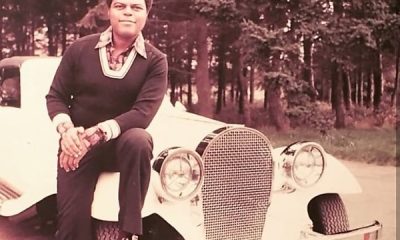

News1 week agoThrowback : Michael Ibru Poses With His Bugatti-style ‘Panther De Ville’ – Britain’s Most Expensive Car At The Time

-

News6 days ago

News6 days agoNASENI CEO Meets With Chairman Of Chery In China To Explore Partnerships On EVs, Local Assembly

-

News6 days ago

News6 days agoNew Bentley Bentayga Speed Sets New ICE-powered SUV Hill Climb Record At Goodwood Festival of Speed

-

News5 days ago

News5 days agoBank Fraud: Court Orders Final Forfeiture Of 9 Luxury Cars, ₦326.4m, $480,000 To FG

-

Car Facts4 days ago

Car Facts4 days agoWhy “AMBULANCE” Is Spelled Backwards Like “ECNALUBMA” In The Front Of Emergency Vehicles

-

News1 week ago

News1 week agoMenacing Range Rover SV Black Arrives As The Darkest And Stealthiest Range Rover Ever Created