They may earn lots of money and flaunt flashy cars, but most footballers prefer to finance their cars instead of buying them outright, thanks to financial advisors.

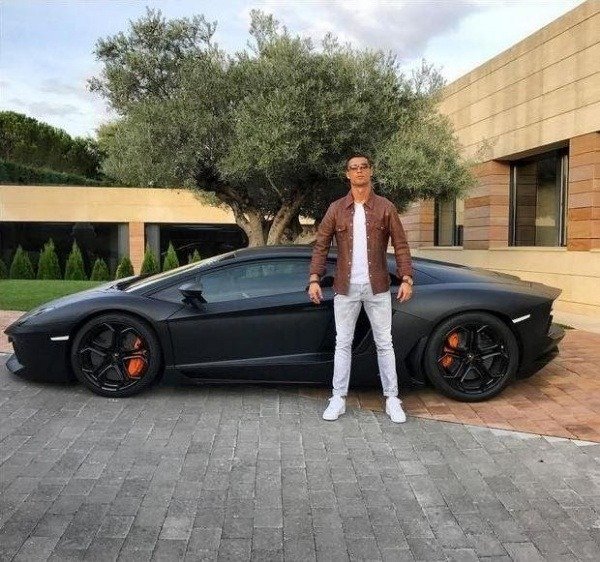

Top footballers like Ronaldo, Sterling, Aubameyang and Salah are often seen flaunting and zooming around town in Rolls-Royces, Bentleys, Lamborghinis and Ferraris that can cost hundreds of thousands of dollars.

But did you know that most of these savvy stars, despite earning fortunes per week, aren’t buying those luxury cars outright.

According to CEO for luxury car finance specialists JBR Capital, Darren Selig, footballers prefer to finance cars because most of their money is invested for them through their financial advisors and agents.

Selig, who gave an insight into how much footballers want to pay, said footballers prefer to pay minimal deposits on their expensive leases.

”Footballers favour financing cars because they still see cars as a monthly cash-flow purchase rather than a capital item,”

“They may well be earning a lot of money, but all that money is invested for them through their financial advisors and agents.”

“At the end, they are left with pocket money, so to speak, and they’re left with a monthly budget to run their lives.”

“Cars are just one of those items they like to spend their money on and enjoy. ”

Selig footballers look for deals, that include 48-month leases, which allow them more flexibility.

Footballers can pay a ten per cent deposit to secure the car, like a brand new Lamborghini Aventador that costs £350,000.

Then with monthly payments of £3,717, they can drive around in an amazing supercar without paying anywhere near the full amount.

But most footballers change their cars well within that time span.

“They do change their cars and swap them quite regularly, because they can get bored of it easily.”

Darren said:

“They tend to keep them sometimes for five minutes.”

“What they pay is largely driven by how much deposit they’re going to put in at the front.”

“They normally do 48-month lease purchase agreements with a balloon at the end.”

“It’s not a question of earning £180,000 a week determining their monthly payments and interest rates.”

“It’s about if they can demonstrate affordability of car that costs £300,000. They don’t have to earn £180,000 a week to demonstrate affordability at that level.”

“It can be significantly lower, but you don’t necessarily treat them any differently over someone who is earning a lot less, but is still earning extremely well.”

“And it’s not specific to another footballer or another individual.”

Why Footballers Prefer Financing Option When Acquiring A Car

Selig explained why footballers and the general public tend to go for the financing option when acquiring a car.

“People finance cars for different reasons,”

“You go from very aspirational people to people who can just about afford to make the affordability criteria.

“Sometimes, the only way to get the vehicle is to finance it. They have maybe £50,000 to finance it, but not £250,000, etc.

“Then you have people who have made money, but historically didn’t have money and came from humble beginnings.

“They are use to the mentality of having to finance cars. They carry on doing that because that’s what they’ve always done and it’s a habitual pattern.

“You also get a category of people who have a lot of money, but choose to finance their cars because they understand cars are depreciating assets.

“Everyone has their own personal reason why they finance their car. Some even may look to buy bigger assets and would rather do than buy a car.”

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News4 days ago

News4 days ago

Latest Cars1 week ago

Latest Cars1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago