A total of 181,404 vehicles were shipped to Nigerian ports in 2017 according to the National Bureau of Statistics. This figure is expected to increase this year and the vehicles have to be cleared through Nigeria Customs in order to get to the door steps of their owners or the car lots of the car dealers. Ordinarily, clearing a car from the ports should be an easy and largely automated task. However, it is plagued with bureaucracies, system downtime, crowd of people to struggle against and dangerous Apapa roads to contend with when clearing in Lagos.

Individuals are usually restricted from handling their clearing jobs themselves. Only licensed clearing agencies get online access and access cards to do the job. This does not mean it is not possible for an individual to clear a car personally. However, they will still need the assistance of a licensed clearing agency at one point or the other.

Today, Autojosh.com will be taking us through the 12 steps involved in clearing a car at the port.

As you read, don’t forget to tell us your port experience. Also drop some tips we can all learn from in the comment section.

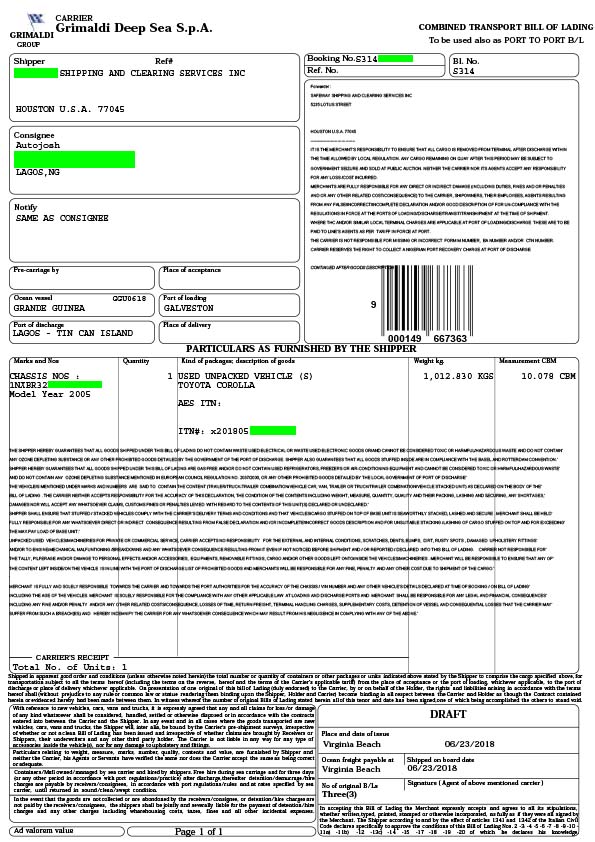

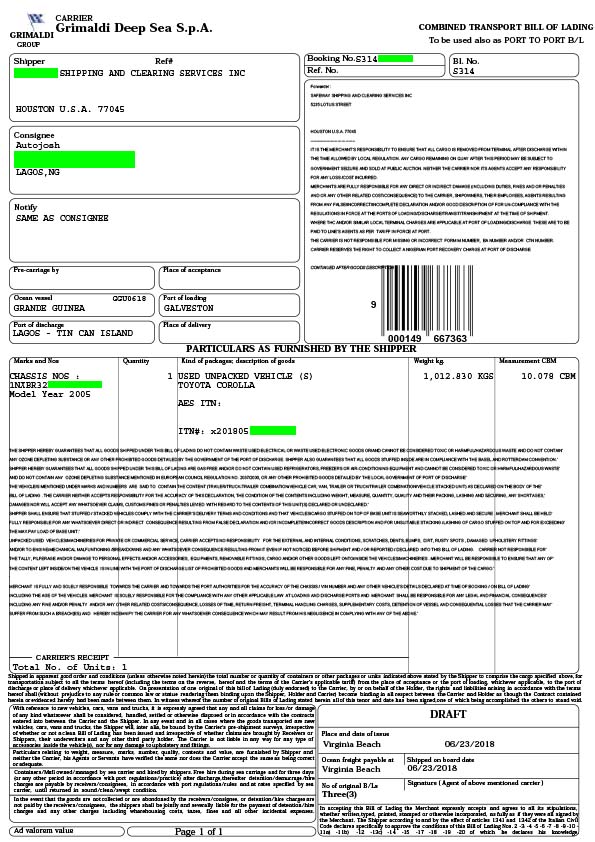

1. Get the vehicle’s bill of lading:

It will be sent to you by your foreign shipping agent. They can send the original bill of lading through courier services (DHL, FedEx, etc). Alternatively you can opt for it to be sent to you via email if you want to do “Telex Release” or “Print at Destination” in which a copy of the bill of lading can be printed here in Nigeria.

Without this document, you won’t be able to do anything in respect of clearing your vehicle. The bill of lading contains the information of the vehicle you want to clear e.g the name, the year, VIN/chassis number, weight, name of vessel, port of origin, port of discharge as well as the details of the shipping agent abroad and the consignee who will receive the vehicle in Nigeria.

This is what a bill of lading looks like below

2. Apply for import duty valuation:

The application must be on the letter head paper of a registered and licensed custom clearing agency. A copy of the bill of lading will be attached to the application letter which will be addressed to the Nigeria Custom office e.g TINCAN, PTML Command etc. Unfortunately, individuals cannot apply for this valuation directly, so you have to apply for it through a clearing agency.

In response to the application letter which will be submitted physically, the custom officials will write the dollar value of the vehicle and this dollar value is what is used to calculate surface duty which is 35%. Additional 35% levy is charged on brand new cars which makes it 70%. This is how to calculate the surface duty assuming the dollar rate of a car is $3000.

$3000 X 35% (import duty rate) X 305.7 (custom official dollar exchange rate) = N320,985

Note that this value is just the surface duty and you’ll still pay tax, terminal, shipping and other charges.

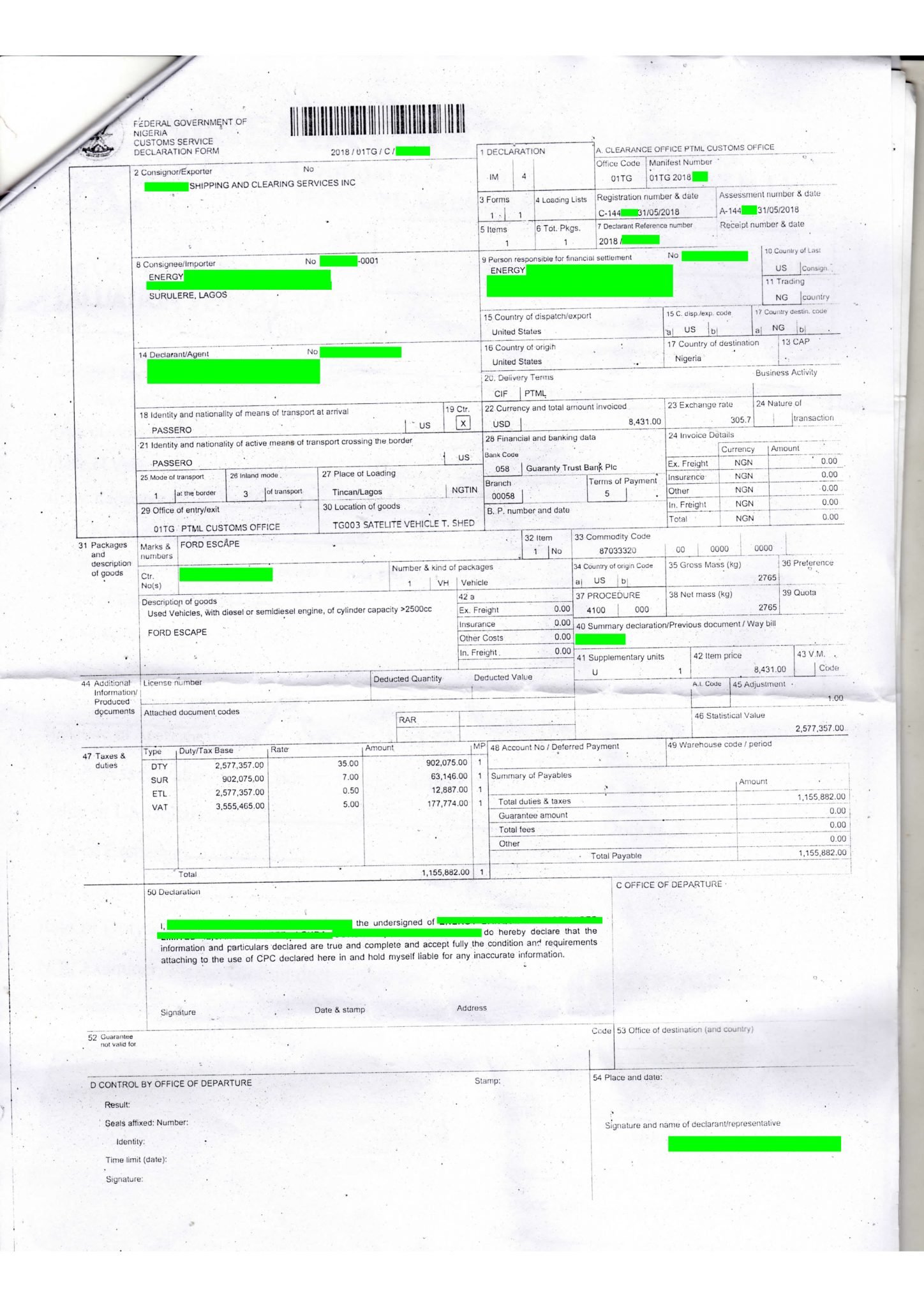

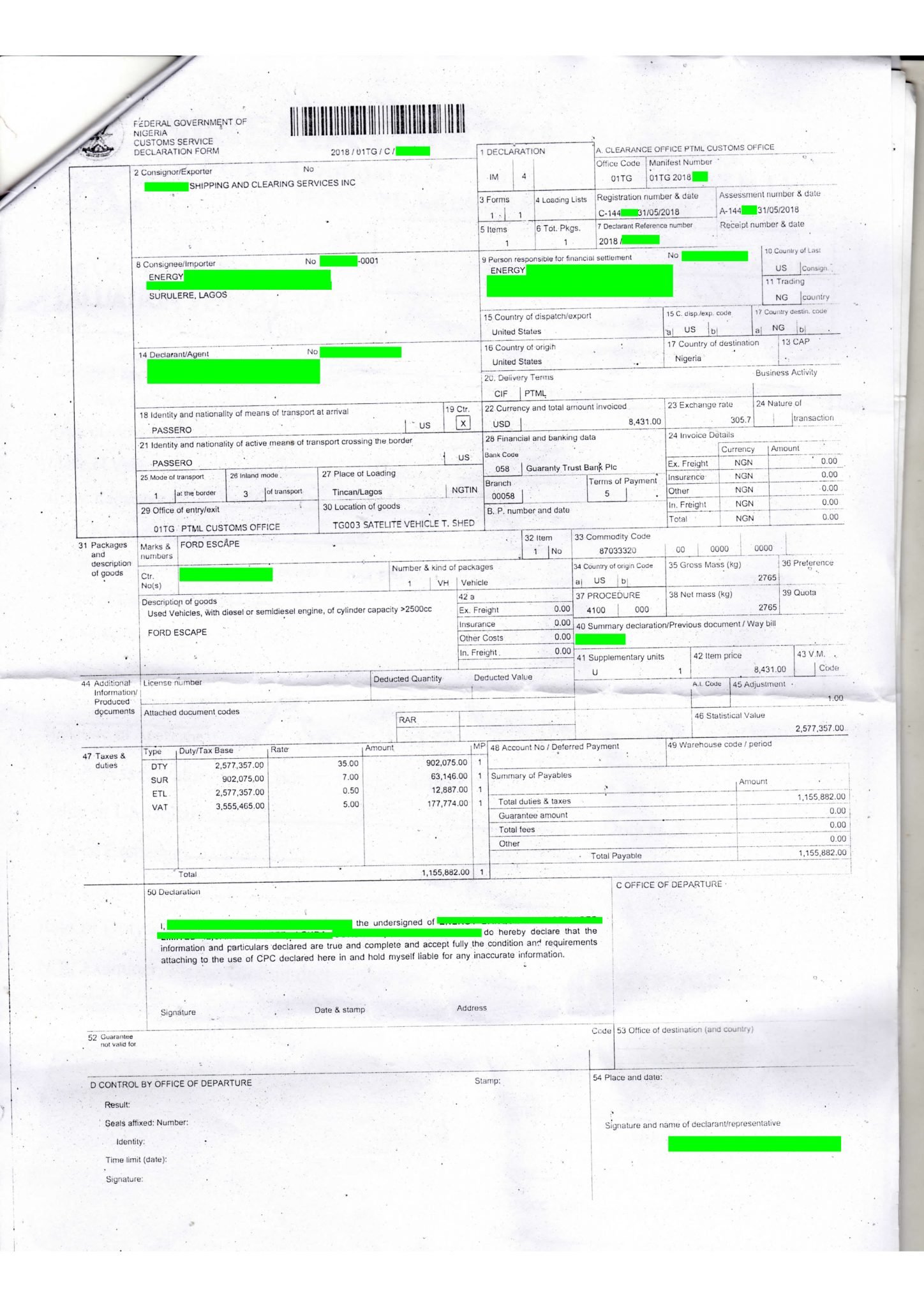

3. Input the valuation into the custom server:

After getting the valuation from the custom command, the details will have to be inputted into the custom server. This is officially called “Direct Trader Input (DTI)”. However, it is popularly referred to as “punching”. It is the unique procedure for submitting electronic manifest to Nigeria Custom Service and it can only be done through the same registered agency whose letter head paper was used to apply for the valuation. The Tax Identification Number of the consignee will also be needed at this stage.

Upon completion, print the DTI also called “Assessment Notice” as well as SGD (Single Goods Declaration Form). The SGD gives a description of the transaction e.g type of vehicle, the terminal it is located, duty amount and content of the car if anything is loaded in it.

See sample copy of a Single Goods Declaration Form (SGD) below..

4. Pay import duty:

The import duty has to be paid to the bank that was stated while punching. The document needed by the bank for import duty payment is the assessment notice.

After the payment is made, the bank will issue a bank receipt. Some banks now accept online payment but evidence of payment will still be picked up from their branch.

5. Physical inspection and releasing from customs:

Collate all the documents and submit them to the custom office. The required documents are: bank receipt, assessment notice, SGD, valuation copy and bill of lading. Upon submission, the documents are registered then they’ll schedule the vehicle for physical examination. This will enable them sight the car and confirm that it tallies with the submitted documents.

They confirm the make, year and VIN/chassis number of the vehicle. They will also check the amount paid for duty and confirm if there is any load in the vehicle after which a report will be submitted to the releasing officer. At this point, the vehicle may not be released if the amount paid is less than the required import duty as an “Alert” may have been placed on that vehicle until the outstanding is paid.

6. Print exit at the shipping company:

After releasing, proceed to the shipping company with the SGD to print exit copy. The is the simplest of all the processes.

7. Release at shipping company:

Collate all your documents to get the car released from the shipping company. The required documents include signed original bill of lading, SGD, exit copy and signed copy of the consignee’s identity (e.g Drivers Licence, International Passport, National ID and duly stamped/singed Certificate of Incorporation for companies). You also need a copy of the Form C30 (Custom document that permits clearing agencies to operate) and an authority letter from the agency whose details was used to apply for valuation. The shipping company will check all these documents then give an assessment to pay for shipping and terminal charges which can be paid as cash, through POS or online transfer.

8. Sign gate at custom office:

Proceed to register and sign at the gate office. The custom release document and the exit copy from the shipping company will be needed. They will check the duty paid and verify it on the system. After which, the officer in charge will stamp and sign-off your document.

9. Collect TDO (Terminal Delivery Order):

To collect the TDO, the shipping company’s payment receipt and copy of the signed gate document are required.

10. Receive delivery of the vehicle at the floor:

Documents can now be submitted for the vehicle to be delivered to the open floor ready to cross the final exit gate.

11. Final custom check:

At the floor, a custom officer and a shipping company official will do their final checks before the car drives out of the port.

12. Final fees:

Before the vehicle is driven out of the gate, final fees will be paid to custom officers on duty, clearing agent’s association, omo-onile fees etc.

Have you ever cleared a car at the port yourself? Tell us your experience in the comment section so we can all learn together.

Don’t forget to like, rate and share.

You can check the import duty for car HERE

Note: These steps are subject to change without notice and may vary from one shipping line or terminal to another. We used cars shipped through Grimaldi and Sallaum RORO (Roll-on/Roll-off) as case study for this write up.

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

News4 days ago

News4 days ago

Latest Cars1 week ago

Latest Cars1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

Dapson

July 6, 2018 at 05:09

Informative!!!

Uju

September 18, 2018 at 20:45

How long does it take to complete this process (Days or Weeks)

AutoJosh

September 19, 2018 at 11:57

6 – 8 weeks

tolu

November 17, 2018 at 20:30

this was an interesting read. crazy how things have to be so complicated in nigeria. i wasnt expecting to see omoniles in the post though. i checked the price to clear some vehicles with your import duty tool, it was really convenient to use. Please is the amount of money displayed by the tool the amount i’m to pay if clearing through you guys or is it the amount i’m to pay if clearing by myself at the customs office?

Nwogbunyama Emeka

November 19, 2018 at 11:35

Those are the amount you pay by yourself. Autojosh clearing your car fro you will attract extra charges

toolz

November 20, 2018 at 14:47

i left a comment earlier and it never got posted. i used the custom duty function on your website and found it pretty useful. but are those prices generated by the import duty app an estimate of what you would pay directly to customs or is it an estimate of what it would cost if i was to clear a car through you guys? and if i bought a 2013 car for $6000, i understand that the surface duty will be 6000x305x35%. i’d like to know how much more is expected of me after handling the surface duty. a rough estimate would be appreciated… thank you

AutoJosh

February 9, 2019 at 13:06

Sorry for the late response. The amount listed on our website is an estimate of what it would cost to clear a car through Nigeria customs. They won’t use your $6,000 to calculate the surface duty. They have their rate sheet which contains predetermined rates. For additional cost, multiply your surface duty by 1.281 to get the total duty. You’ll also pay shipping and terminal charges between 70k and 80k as well as some additional charges which will be determined by Customs.

MIKE

January 3, 2019 at 19:29

GOOD EVEINING? PLEASE I WANT TO FIND OUT HOW MUCH TO CLEAR A ES 2014 OR 2015 ACCIDENT CAR. HOW CAN I DO IT CHEAPLY AND LASTLY CANI HAVE IT SHIP TO OTHER AMERICAN COUNTRY , THEN PAY THE DUTY AT A NIGERIA CUSTOM OFFICE IN SEME BOARDER

AutoJosh

February 9, 2019 at 12:49

Expect to clear the car in the range of N1.75m. You can apply to Nigeria custom for a 10% to 15% reduction in the duty amount if the car has a bad damage to the chassis or the airbags are deployed. Seme border is not an option because importation through the land border has been banned.

Olalekan

January 15, 2019 at 01:18

Pls if i paid custom duty with shipping from dubai to Nigeria, will i still need to pay for clearance of my car?

AutoJosh

February 9, 2019 at 12:45

No you don’t have to pay for clearing again. They will clear the car on your behalf and you should pick it up from their warehouse.

Jobal

September 19, 2020 at 15:00

How much will it cost me to clear Mazda Premacy 2004 in Nigeria?

AutoJosh

October 2, 2020 at 16:33

The average cost for clearing 2004 Mazda Premacy is N420k